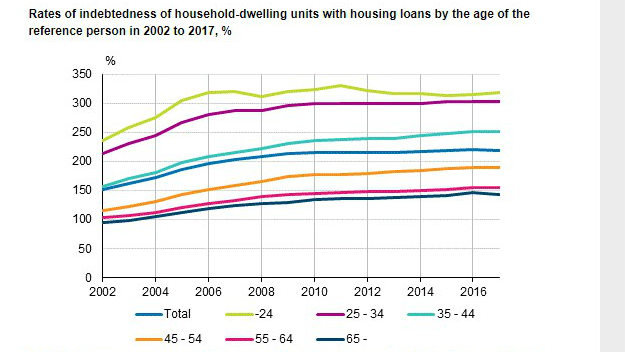

In 2017, household-dwelling units with housing loans had, on average, 219 per cent of their disposable income in debt, according to the latest figures published by Statistics Finland. Household-dwelling units in the group under the age of 35 had the largest debts in proportion to income.

Their debt was, on average, a little over three times their annual income. The average size of a housing loan per household-dwelling unit with a housing loan was 98,740 euros, which was 0.8 per cent more than in the previous year.

Statistics Finland highlights that in 2017, the total number of indebted household-dwelling units was 1.4 million euros, slightly over one-half of all household-dwelling units. Their debt amounted to 120.9 billion euros in total, which was 1.9 per cent more than the previous year. Since 2002, the number of indebted household-dwelling units has gone up by ten per cent and the debts by 117 per cent in real terms.

Source: Statistics Finland

Debts grew by 1.9 per cent from the previous year. Household-dwelling units’ disposable monetary income grew slightly more than their debts, by 2.4 per cent, so the rate of indebtedness of household-dwelling units fell slightly. In 2017, the rate of indebtedness of all household-dwelling units was 112 per cent, while it was 113 per cent the year before.

One-third of debts are housing loans

According to Statistics Finland, 86.8 billion euros, or 72 per cent of debts were housing loans. One-third of all household-dwelling units, or 878,800, had housing loans. The housing loans grew by 0.7 per cent year-on-year.

Altogether 80,260 household-dwelling units had debts taken out for business purposes. They amounted to 7.4 billion euros, which was 2.5 per cent more than in the previous year. Around one million household-dwelling units had other debts amounting to 26.7 billion euros, 5.7 per cent more than in the previous year. Other debts include loans for consumption and larger purchases, such as a car or free-time residence, as well as student loans.

In almost one-fifth of indebted household-dwelling units, that is, 269,750 household-dwelling units, the debts were three times as high as their disposable annual income. They held one-half of household-dwelling units' all debts. In 2002, altogether 97,380 household-dwelling units were this much in debt, that is, eight per cent of indebted household-dwelling units. Household-dwelling units that had debts at least five times as high as their annual income numbered 66,740 in 2017.

Two-supporter families with children, where the reference person was aged under 45, often had much debt compared to their disposable income. In childless household-dwelling units with one or two adults high debts were more common in household-dwelling units of those aged 25 to 34. Single-supporters with housing loans often had much debt compared to the income.

Higher loans in Åland and Helsinki

Household-dwelling units in Åland, Greater Helsinki and elsewhere in Helsinki-Uusimaa had the highest housing loans. Forty-one per cent of the household-dwelling units with housing loans in Åland, 37 per cent in Greater Helsinki and 33 per cent elsewhere in Helsinki-Uusimaa had debts that were at least triple their annual income. High housing loans are found least in Northern and Eastern Finland, where one quarter of the household-dwelling units with housing loans had that much debt.

Of the household-dwelling units belonging to the lowest income quintile, 43 per cent had debts that were at least triple compared with their annual income, while 24 per cent of the household-dwelling units in the highest income quintile had as much debt in relative terms. On average, household-dwelling units belonging to the lowest income quintile had 64,490 euros in housing loans and those in the highest income quintile 127,920 euros.

Household-dwelling units paid 1.6 billion euros in interests in 2017. Household-dwelling units’ interest expenses decreased by 1.8 per cent from the previous year. From 2002 to 2017, household-dwelling units’ interest expenses have decreased by 43 per cent in real terms, while household-dwelling units’ debts have more than doubled in the same time.

Altogether 60 per cent, or 853,100, of indebted household-dwelling units paid at most 1,000 euros in interests and three per cent, or 37,000 household-dwelling units, paid more than 5,000 euros.