Finnish households increased their saving rate in the second quarter of 2020, which coincided with the global expansion of the coronavirus pandemic and the closures decreed to contain the virus. And the most striking thing is that they saved much more despite the fact that their disposable income was much lower.

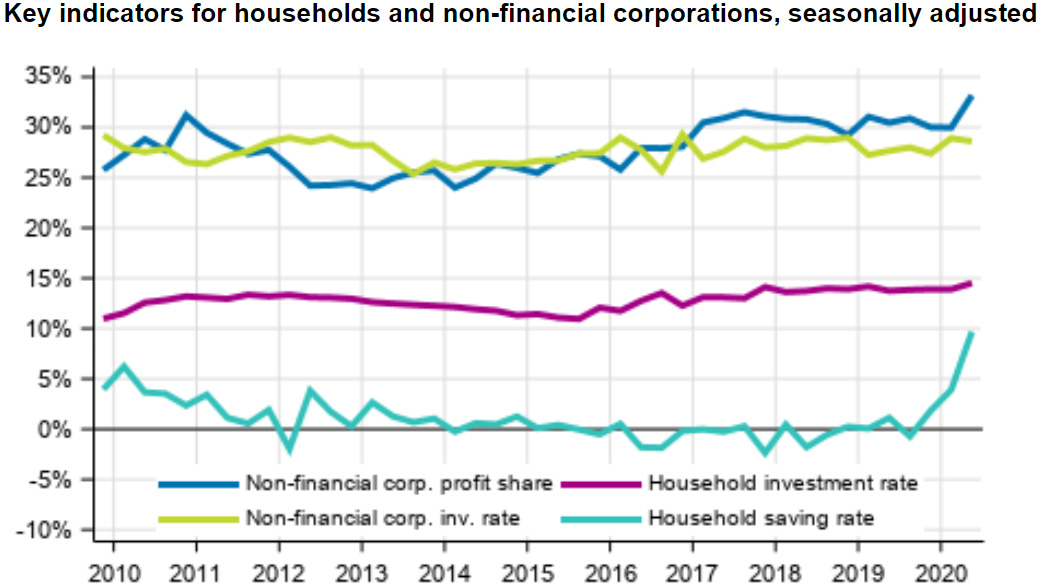

According to Statistics Finland's figures, in April to June, households' seasonally adjusted saving rate grew by nearly six percentage points to 9.7%. The savings is derived by deducting consumption expenditure from disposable income.

The explanation is simple: the saving is positive if households' disposable income is greater than consumption expenditure. The saving rate refers to the share of households’ savings in disposable income.

From April to June, in the midst of a general wave of layoffs, reductions in working hours and business closures, households' disposable income decreased, but consumption diminished clearly even more, which resulted in a significant increase in the saving rate.

Source: Statistics Finland.

Disposable income

In the second quarter of 2020, households’ disposable income decreased at current prices by 1.7%, that is, by about half a billion euros from the corresponding quarter of the year before.

The key components of disposable income on the income side are wages and salaries received, entrepreneurial and property income, and social benefits received.

The biggest expense items are taxes paid and social contributions.

Wages and salaries received in the second quarter of 2020 decreased by over 1 billion euros and property income by 0.7 billion euros, while social benefits received grew by nearly one billion euros compared to the figures one year ago.

On the expense side, both taxes paid and social contributions paid decreased, but less, in total close to half a billion euros compared with the figures one year ago.

Households investments

Households' seasonally adjusted investment rate grew slightly from the previous quarter and stood at 14.5%. The investment rate is the ratio of households' investments to disposable income.

Most of households' investments were investments in dwellings.

Households' investments remained in practice on level with the previous quarter but the investment rate rose clearly as disposable income diminished.