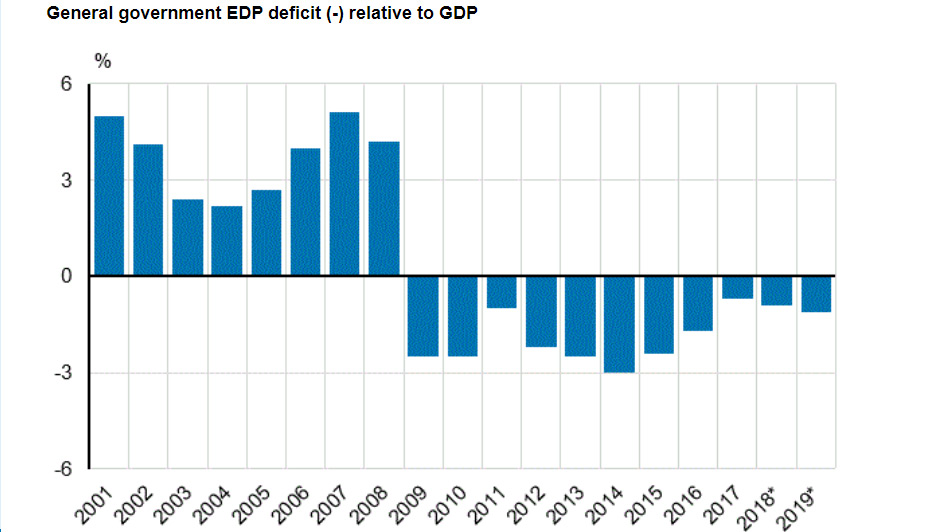

According to the revised preliminary data reported by Statistics Finland to Eurostat, general government deficit was 1.1% to Gross Domestic Product (GDP) in 2019. The deficit grew compared to the previous year, but still it was below the reference value of the European Union’s Stability and Growth Pact, which is 3% relative to gross domestic product.

General government EDP debt, or consolidated gross debt, was 59.4% at the end of 2019 relative to GDP. The ratio of debt to GDP is also below the reference value of 60%.

In 2019, general government deficit, or net borrowing according to national accounts, was 2.7 billion euros. The financial position of general government weakened by around 700 euros million from the year before. The financial position of local government weakened most, by around 900 million euros compared to 2018. This was particularly due to significant increases in the sector’s consumption expenditure and investments. In 2019, local government sector deficit, or net borrowing, was 2.9 billion euros.

Source: Statistics Finland.

From 2018, central government deficit decreased by 110 million euros, but still remained clearly in deficit. The deficit of central government stood at 2.8 billion euros in 2019.

Social security funds are divided into employment pension schemes and other social security funds. The employment pension schemes’ surplus was 2.2 billion in 2019, more or less the same as in the previous year. The surplus of other social security funds was 0.7 billion euros.

Debt grew by 3 billion

Consolidated general government gross debt (EDP debt) amounted to 142.5 billion euros at the end of 2019. The debt grew by around 3 billion. Central government debt grew by 1.4 billion euros and local government debt grew by 2.9 billion.

The debt of social security funds decreased by 0.9 billion euros. The increase in consolidated items between general government by 229 million euros contributed to the debt of the entire general government sector growing by 1 billion in 2019.

The EDP debt describes general government’s debt to the other sectors of the economy and to the rest of the world, and its development is influenced by changes in both the unconsolidated gross debt and the internal general government debt.