The Finnish government spends much more money than it takes in. This is neither new nor unusual.

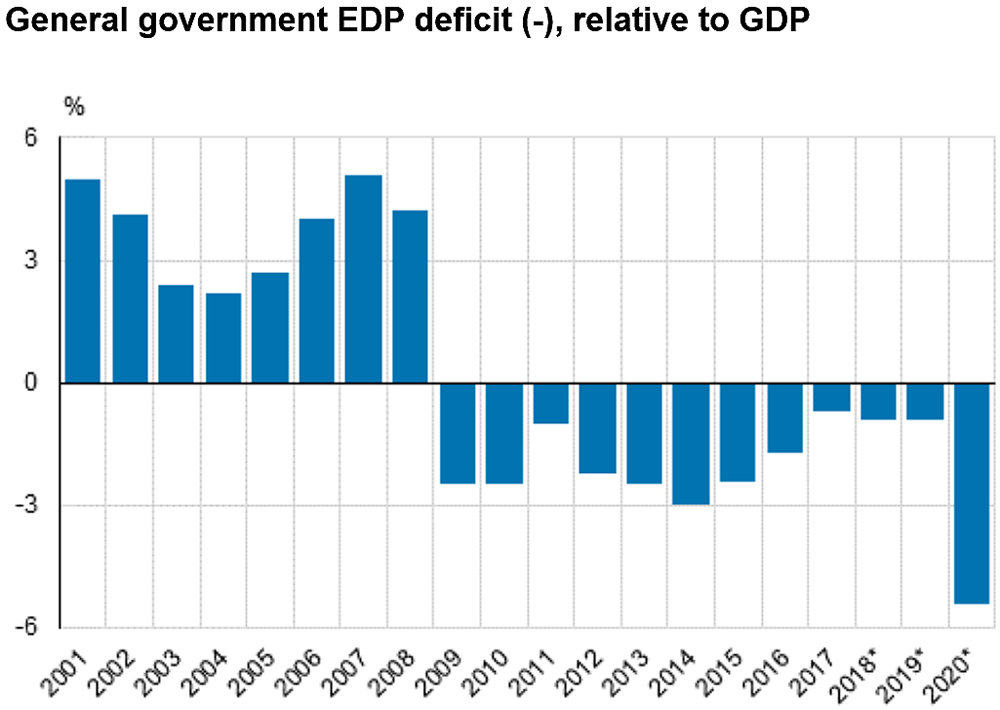

Finland has been carrying an imbalance in its public accounts for twelve years, since the last financial crisis. But it was in 2020, with the coronavirus crisis, when the country broke its record in terms of deficit and debt, both shooting above the limits of the Stability and Growth Pact of the European Union.

Source: Statistics Finland.

Source: Statistics Finland.

According to the revised data reported by Statistics Finland to Eurostat, in 2020 general government deficit was 5.4% relative to gross domestic product (GDP), which exceeds the 3% limit of the European Stability Pact.

General government deficit, or net borrowing according to national accounts, was 12.9 billion euros. The financial position of general government weakened by good 10 billion compared with 2019.

The financial position of central government weakened most: its total revenue decreased by 3.2 billion euros and total expenditure grew by 7.6 billion.

The growth in total expenditure was particularly caused by the increase in income transfers to other sectors.

The worst thing about having an administration in deficit is that someone has to put the money to keep it running. And that can only be done by the government by borrowing. Hence, the country's debt also skyrocketed in 2020 above the limit set by Brussels.

General government debt

According to Statistics Finland's figures, the ratio of debt to GDP was 69.2% relative to gross domestic product at the end of 2020, also well above the reference value of 60%.

Source: Statistics Finland.

Source: Statistics Finland.

Consolidated general government gross debt - the one that counts in terms of the EU's excessive deficit procedure (EDP) - amounted to 164.3 billion euros at the end of the year, which is 21.4 billion more than in 2019.

Central government debt grew by 17.6 billion and local government debt by 1.7 billion.

The debt of social security funds grew by 2.2 billion euros.

Brussels understands that what happened in 2020 has been exceptional and that the debt and deficit figures of the countries are not due only to poor management by governments. That is why, in 2020, the European Commission introduced a general escape clause from the Stability and Growth Pact, allowing a temporary deviation from the deficit and debt requirements.

In practice, for Finland this means that it will avoid having to undergo an excessive deficit procedure, which would imply the obligation to present in Brussels a plan to balance the public accounts and, if necessary, a subsequent plan of structural reforms.