Direct taxes continue to rise in Finland, according to the latest accounts published by Statistics Finland.

Income earners paid 30.7 billion euros in direct taxes in 2018, which was in nominal terms 2.4% more than in the year before.

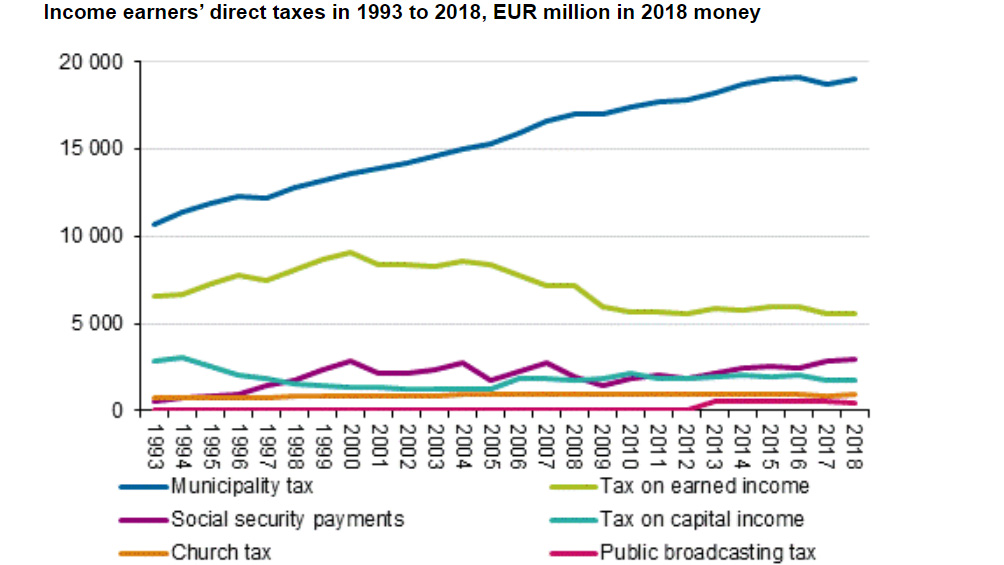

The destination of those payments was varied. Residents in Finland paid 19 billion euros in municipal tax, 5.5 billion euros in state taxes on earned income, 3 billion euros in taxes on capital income and 492 million euros in public service broadcasting tax.

The amount of municipal taxes grew from the previous year by 2.5%, income tax by 0.4%, taxes on capital income by 6.2% and public service broadcasting tax by 0.5%. Municipal tax was paid by 3.9 million persons, both taxes on earned and capital income by 1.4 million and public service broadcasting tax by 3.4 million persons. Source: Statistics Finland.

Source: Statistics Finland.

Taxes increased by 44% in 25 years

Direct taxes have increased by 44% in real terms from 1993 to 2018.

During the same period, the amount of municipal tax has grown by 78% and its share of direct taxes has increased from 50 to 62%. Income earners paid 15% less taxes on earned income in real terms than in 1993 and that share of taxes decreased in this period from 31 to 18%. The share of capital tax in taxes has varied between close on 3 to 10%. In 2018, it was 9.8 per cent.

Taxable income increased

Taxable income received by income earners totaled 143.7 billion euros in 2018, which was 3.2% more than in the previous year. Of taxable income, 132.9 billion euros were earned income and 10.7 billion euros capital income. Earned income grew by 2.9% and capital income by 6.4% from the previous year.

Most of taxable income, 88.7 billion euros or 62%, was earned income. The next biggest group was pension income, 22% or 31.7 billion euros. From the previous year, wages and salaries grew by 4.2% and pensions by 2.4%.

Earned income was received by 2.8 million persons and pension income by 1.7 million persons. 4.1 billion euros of the income were daily unemployment allowances and other benefits based on unemployment security, which was 12% less than in the previous year.