The 5-party coalition government headed by Prime Minister Sanna Marin (Social Democratic Party, SDP) reached a medium-term budget agreement on Wednesday. The deal came after more than a week of intense negotiations and prevented the cabinet from collapsing.

The leader of the Center Party (Keskusta), Annika Saarikko, threatened to abandon the government pact, in a move that caused deep unease and has been widely described by Finnish experts and the mainstream media as "theater" and "dramatization".

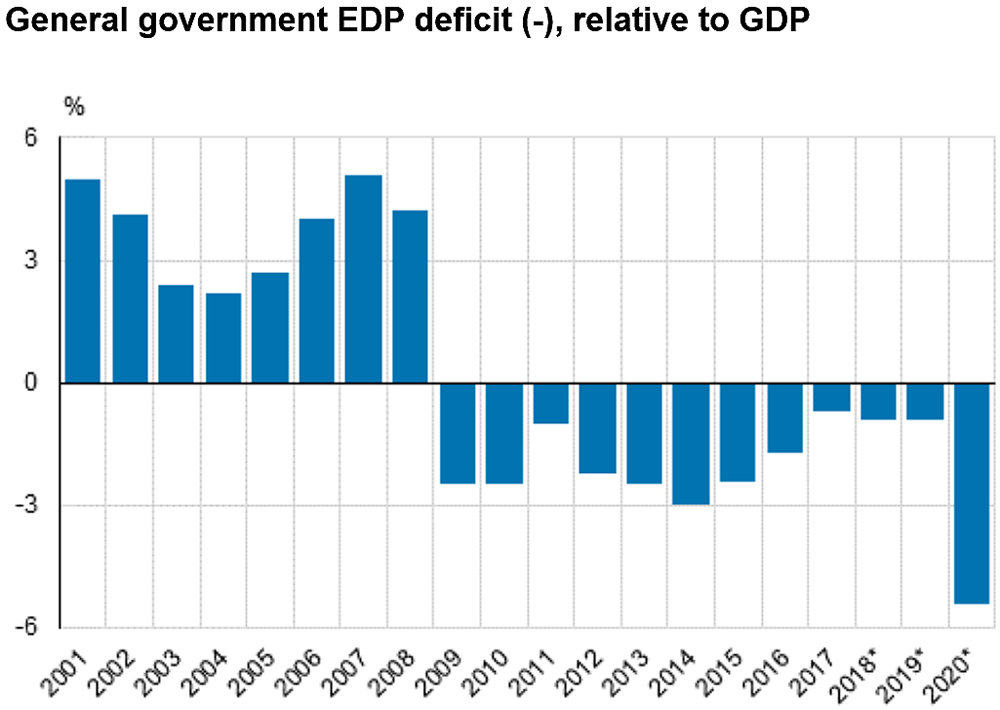

In the end there was no rupture, as it was expected, and the Finns have found themselves with a fiscal program with which the government intends to face reconstruction after the Covid-19 epidemic, improve employment and boost economic growth. The problem is that public finances have been in deficit since 2009 and this year they could show a record-breaking imbalance, as reflected in the government's plan.

Source: Statistics Finland.

The Ministry of Finance admits that, as a result of the coronavirus crisis, the overall picture of the Finnish economy and of the country’s financial policy needs "diverges significantly from the autumn 2019 situation when the spending limits for the parliamentary term were set."

During the pandemic, the government has pursued an exceptionally expansionary fiscal policy with the aim of propping up growth and employment, maintaining the welfare state and avoiding a permanent loss of productive capacity. Consequently, public spending was raised in areas that fall within the expenditure ceiling.

Future roadmap

These policies did not prevent the fall of the Gross Domestic Product (GDP) and the destruction of employment, although these undesired effects were less intense than in other European states.

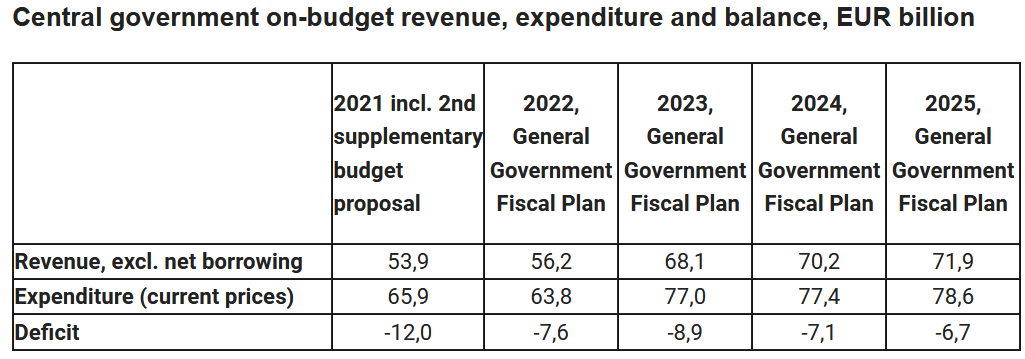

For the future, the government intends to follow a similar roadmap, with more spending, even if that means that the deficit temporarily goes through the roof: central government deficit will reach 12% this year and in 2023 it will still remain around 9%. There will be also more taxes and public debt will continue to rise.

The spending limits will be raised also for 2022 (with an additional 900 million euros) and 2023 (with 500 millions more).

On-budget expenditure in 2022 is estimated at 63.8 billion euros, which is about 2.1 billion euros less than has been budgeted for 2021 (including the year’s second supplementary budget). This lower level of expenditure compared with 2021 is attributable particularly to the reduction in spending as a consequence of the pandemic.

Source: Finnish Government.

Central government debt is expected to climb to approximately 145 billion euros in 2022.

The ratio of total central government debt to GDP will rise throughout the budget planning period. Central government debt in 2025 is estimated to be approximately 167 billion euros, or about 59% of GDP.

These figures correspond only to the central government, it will be necessary to see what happens with the rest of the administration to measure the total deficit and debt ratios of the general government.

According to Statistics Finland's figures, the general government ratio of debt to GDP was 69.2% at the end of 2020, which exceeds the 60% limit of the European Stability Pact. The general government deficit was 5.4% relative to GDP, also well above the reference value of 3%.

A 'tax package'

The 2021 government budget session will decide on "a tax package to strengthen central government finances by 100–150 million euros and, in addition, on other tax changes to encourage investment and enhance competitiveness."

By now, the government has announced that taxes on tobacco will be increased by a total of 100 million euros in 2022-2023 and tax aids on synthetic diesel will also be eliminated, providing another 87 million euros.

To "broaden the tax liability of foreign investors", the government wants to ensure that profits made by foreign funds in real estate investments "are taxed as widely as possible" in Finland.

Taxation decisions will be made also to "encourage the replacement of heating systems that operate on fossil fuels," the government warns.

The good news for salaried employees is that the government promises to introduce changes so that wage-earners will not see an increase in the taxation on work.

The government says that there will be also adjustments in the tax base of earned income, in order to avoid an increase in taxes as a result of a general increase in earnings.